- Home

- Contact Nightcliff Bank

- NCB Staff

- News & Updates

- Apply for Grants

- Supported Activities

- Jetty ArtSpace Winners

- Jetty ArtSpace 2025

- Community Support

- 15 Year Birthday

- Nightcliff Market Stall

- Nightcliff Marquee

- Urban Quest

- Community Forum

- N.C.E.Limited

- NCEL Shares

- Bendigo Bank Award

- Financial Claims Scheme (FCS)

- Community Values

- Home

- Financial Claims Scheme (FCS)

Financial Claims Scheme (FCS)

The issuer of any deposit products that may be provided through our Community Bank branches is Bendigo and Adelaide Bank Limited, ABN 11 068 049 178 AFSL / Australian Credit Licence 237879.

Deposits with Bendigo and Adelaide Bank Ltd are protected under the Australian Government’s Financial Claims Scheme.

1. What is the Financial Claims Scheme?

The Financial Claims Scheme (FCS) is an Australian Government scheme that provides protection and quick access to deposits in banks, building societies and credit unions in the unlikely event that one of these financial institutions fails.

Under the FCS, certain deposits are protected up to a limit of $250,000 for each account holder at any bank, building society, credit union or other authorised deposit-taking institution (ADI) that is incorporated in Australia and authorised by the Australian Prudential Regulation Authority (APRA).

The FCS can only come into effect if it is activated by the Australian Government when an institution fails. Once activated, the FCS will be administered by the Australian Prudential Regulation Authority (APRA).

In an FCS scenario, APRA would aim to pay the majority of customers their protected

deposits under the Scheme within seven calendar days

2. How is the FCS limit applied?

The FCS limit of $250,000 applies to the sum of an account holder's deposits under the one banking license.

Therefore, all deposits held by an account holder with a single banking institution must be added together towards the $250,000 FCS limit, and this includes accounts with any other banking businesses that the licensed banking institution may operate under a different trading name.

Bendigo and Adelaide Bank Limited’s network of brands and joint ventures provide a

wide range of products and services, and those that are covered by the FCS are Bendigo

Bank, Adelaide Bank, Community Bank, Alliance Bank, Rural Bank, Up Bank and Delphi

Bank. Therefore, the $250,000 limit will apply to the aggregate balance of any eligible

accounts held across these brands and joint ventures.

3. Where can I get further information on the FCS?

Further information on the FCS is available on the FCS website. The APRA website also

contains a list of FAQ’s relating to banking

Sharka donated the $1000 AGM door prize to NT Legacy.

Sharka donated the $1000 AGM door prize to NT Legacy.2024 Report on Social Enterprises (RISE)

Nightcliff Community Enterprises Ltd,

T/A

Community Bank Nightcliff

Qualifies as a Social Trader because it provides up to 80% of profits to local organisations.

You can help develop more community support simply by using the services provided by your local Community Bank..

14 Years of Support for the Annual Nightcliff Bowls Competition

14 Years of Support for the Annual Nightcliff Bowls Competition Sponsored BMX Bikes for Kids

Sponsored BMX Bikes for Kids Supporting Fannie Bay Equestrian Club

Supporting Fannie Bay Equestrian Club $1000 donation to Retina Australia

$1000 donation to Retina Australia Helping TWHF support Australian Ovarian Cancer research

Helping TWHF support Australian Ovarian Cancer researchNewsletter

Keep up with the news with a subscription to

Nightcliff Community Newsletter

NTeen Fashion Festival 2019. It offers opportunities for the Youth of the Northern Territory to engage, learn and grow

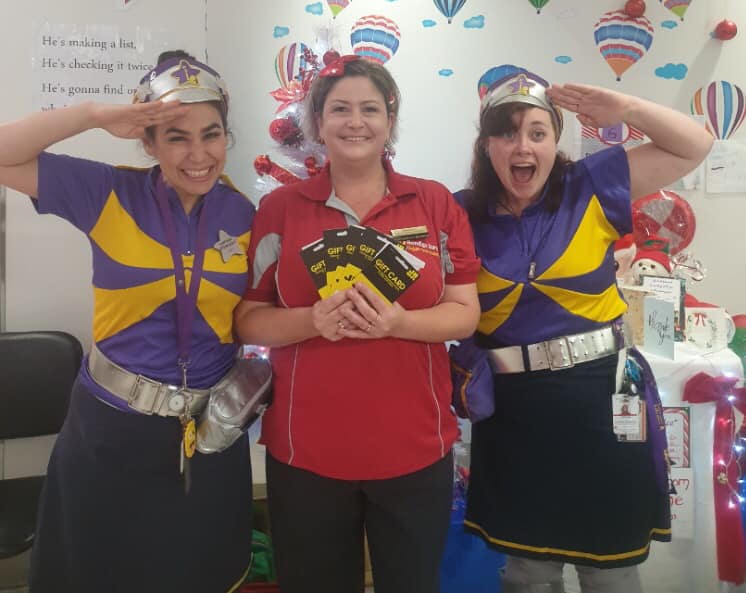

NTeen Fashion Festival 2019. It offers opportunities for the Youth of the Northern Territory to engage, learn and grow Nightcliff Community Toy donations to RDH 2019

Nightcliff Community Toy donations to RDH 2019 New Tigers scoreboard

New Tigers scoreboard See the Magnificent Community Mural at Tactile Arts

See the Magnificent Community Mural at Tactile Arts Open Category Winner 2015

Open Category Winner 2015 Supporting Nightcliff Youth

Supporting Nightcliff Youth Netball 2016

Netball 2016 Darwin Hospice

Darwin Hospice